how much taxes does illinois take out of paycheck

Everyones income in Illinois is taxes at the same rate due to the states flat income tax system of 495. Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding amount its not that easy.

Is It Possible For A Weekly Salary Of 500 To Have Over 100 Of Taxes Taken From Each Paycheck Quora

W4 Employee Withholding Certificate The IRS has changed the withholding rules.

. For 2022 the limit for 401 k plans is 20500. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay.

During the course of employment no cash advance repayment agreement can provide a repayment schedule of more than 15 of an employees wages per paycheck. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Well do the math for youall you need to do is enter the.

The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our. How much taxes does illinois take out of paycheck Sunday February 27 2022 Edit Each pay period 62 of your paycheck goes to your share of Social Security taxes and 145 goes to.

For wages and other compensation subtract any exemptions from the wages paid. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck. Unlike Social Security Medicare taxes are levied on all incomes.

Employers in Illinois are required to remove 145 percent from each employees paycheck as a state mandated deduction. How do I calculate how much tax is taken out of my paycheck. As of 2018 the state income tax rate for Illinois is 495 percent of income after deducting for allowances the employee claims on IL-W-4.

Also not city or county levies a local income tax. Employers can find the exact amount. Your average tax rate is 229 and your marginal tax rate is 346.

Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. Employers are responsible for deducting a flat income tax rate of 495 for all employees. How much is payroll tax in Illinois.

What is federal income tax. Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return. Its important to note that there are limits to the pre-tax contribution amounts.

Generally the rate for withholding Illinois Income Tax is 495 percent. Illinois Hourly Paycheck Calculator. Personal income tax in Illinois is a flat 495 for 20221.

According to the Illinois Department of Revenue all incomes are created equal. The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income. For those age 50 or older the limit is 27000.

In 2021 the federal income tax rate tops out at 37. Check out our new page tax change to find. Helpful Paycheck Calculator Info.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Illinois. It can also be used to help fill steps 3 and 4 of a W-4 form. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Chapter 5 Taxes Ppt Video Online Download

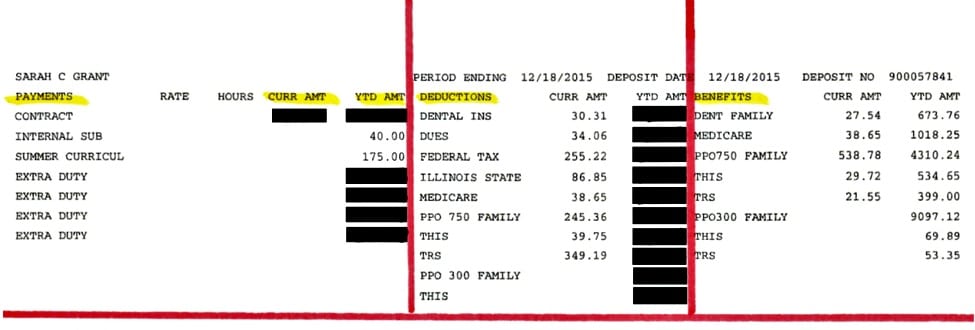

Understanding Your Teacher Paycheck We Are Teachers

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Taxes 5 1 Taxes And Your Paycheck Payroll Taxes Based On Earnings Paid To Government By You And Employer Income Taxes You Pay On Income You Receive Ppt Download

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

I Make 800 A Week How Much Will That Be After Taxes Quora

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Paycheck Calculator Take Home Pay Calculator

Why Illinois Is In Trouble 109 881 Public Employees With 100 000 Paychecks Cost Taxpayers 14b

Paycheck Calculator Take Home Pay Calculator

New Tax Law Take Home Pay Calculator For 75 000 Salary

2022 Federal State Payroll Tax Rates For Employers

How Much Should I Set Aside For Taxes 1099

Illinois Paycheck Calculator Adp

New Tax Law Take Home Pay Calculator For 75 000 Salary

Here S How Much Money You Take Home From A 75 000 Salary